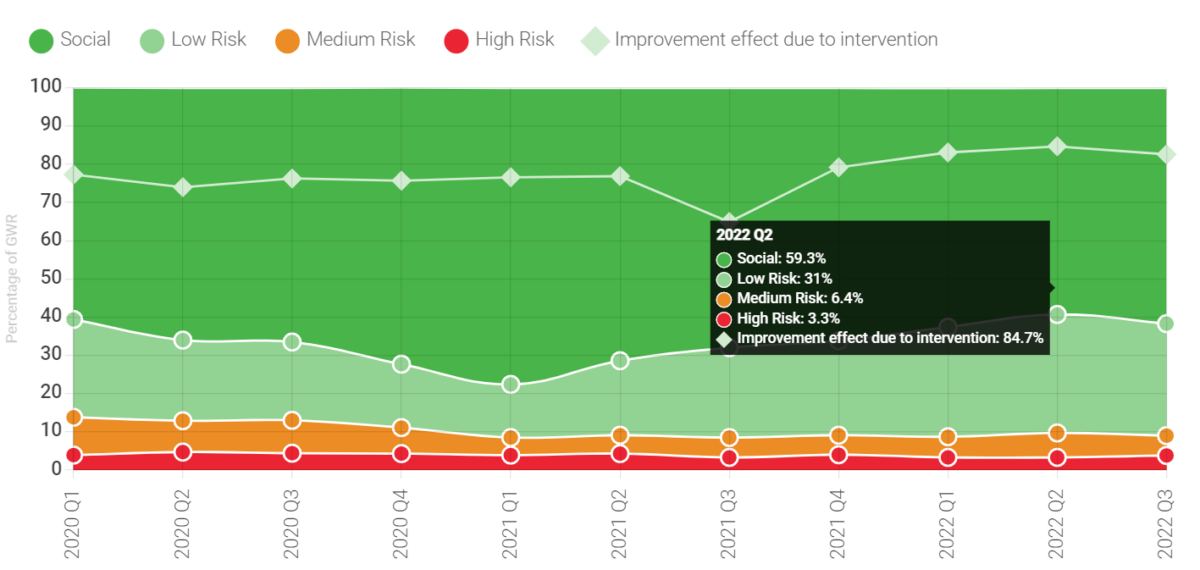

Online gambling operator Kindred Group highlighted its drive to reduce high risk customers and promote healthier betting trends in an announcement prior to releasing its third quarter results for 2022. The main focus for Q3 is the share of gross revenue from high-risk players and the improvement effect after interventions to motivate customers into healthier betting behaviour. Technology to detect high risk gamblers at an early stage will be strengthened in a new partnership with EPIC Risk Management.

Kindred Group’s share of revenue over the last three quarters from harmful gambling has fluctuated between 3.3 per cent and 3.8 per cent.

Four critical areas to work on have been identified:

- Shortening the time from detection to intervention to raise awareness to customers early on

- Continued investment in and collaboration with researchers to further understand gambling behaviours

- Ensuring control tools are visible and used in the right way

- Improving transparency and knowledge sharing within the industry

CEO of Kindred Group Henrik Tjärnström explained that partnerships and knowledge-sharing with regulators and within the industry improve transparency and are important to the Group’s future growth. He added “We will continue to improve our technology and processes so that we increase our efficiency and speed in detecting and engaging with customers at risk. We know this has a positive effect. For the third quarter almost 83 per cent of detected customers improved their behaviour after we reached out to them”. The group identified the critical factors that need further work to reduce revenues from high-risk customers to zero per cent.

Dan Spencer, Director of Safer Gambling at EPIC Risk Management confirmed that Kindred have placed value in player protection by reducing revenues from high-risk players. He stated that EPIC is extending the partnership with Kindred for another three years adding that Kindred was “the first operator that we worked with. This partnership will ensure that EPIC remain part of that journey by providing industry leading consultation services”.

Kindred Group, previously known as Unibet plc, is listed on the Stockholm Stock Exchange. It offers online casino, poker and sportsbook to over 1.3 million registered customers. It is registered in Malta with offices in Gibraltar, London, Stockholm and the US.