Paysafe, a leading specialized payments platform, this week announced that it has signed a definitive agreement to acquire market-leading German fintech company, viafintech, in an all-cash transaction. viafintech, known under the brands of Barzahlen/viacash and viacash, offers the largest, bank independent, payments infrastructure in the DACH region, allowing a popular alternative to the traditional banking structure.

For Paysafe, this latest acquisition not only boosts its growth opportunities in Germany, a critical market for its international merchants, it also creates revenue-generating opportunities to cross-sell viafintech’s alternative banking and payments solutions to its merchants around the world.

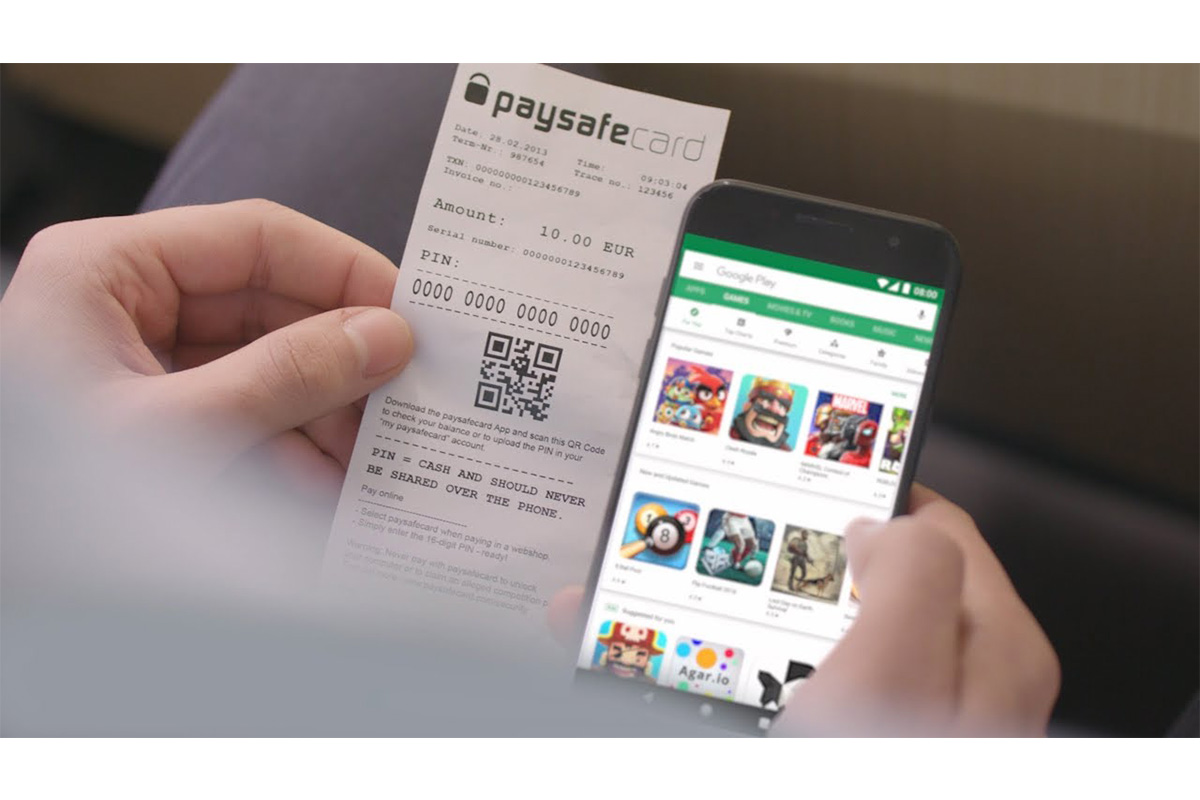

Paysafe’s core purpose is to enable businesses and consumers to connect and transact seamlessly through industry-leading capabilities in payment processing, digital wallets, eCash and open banking solutions. It offers over 70 payment types in over 40 currencies around the world.

As part of the deal, the viafintech team, including viafintech’s managing directors, Sebastian Seifert, Achim Bönsch and Andreas Veller, will become part of Paysafe’s expanding eCash and open banking solutions’ team which is headed up by Paysafe eCash CEO, Udo Müller.

Following the sale of their shares to Paysafe, viafintech’s majority shareholder – Glory Ltd., a global leader in cash technology solutions – will enter into a new strategic partnership with Paysafe. The two companies have signed a referral agreement that enables Glory to offer paysafecard, one of Paysafe’s leading eCash solutions, as a form of payment within its in-store payments kiosks, and, in turn, for Paysafe to offer Glory’s cash technology solutions to its merchants around the world.

Meanwhile, GRENKE BANK AG, which has been providing viafintech’s German bank license and proven regulatory framework since 2017, as well as being a shareholder of the company, will continue to provide the same banking service going forward.

Udo Müller, CEO, Paysafe eCash and Open Banking, commented:

“We are very excited to welcome a star player like viafintech into the Paysafe family. We believe the team are perfectly positioned to take advantage of the shift away from the legacy banking system in Germany and beyond as more and more challenger banks enter the market and consumers opt to use mobile-based solutions for banking and payments. By combining viafintech’s leading solutions with our existing eCash and APM portfolio, we are well positioned as an essential payments partner to challenger banks around the world as consumer banking habits continue to evolve.”

Sebastian Seifert, Co-founder and Managing Director of viafintech, added:

“We are delighted to become part of the Paysafe Group and believe this move will enable us to build on our business achievements to date and accelerate our future growth as Europe’s number one, non-banking, cash-in / cash-out infrastructure, further fuelling the shift away from legacy banking and driving more financial inclusion in general.”

The transaction is expected to close over the coming months, subject to customary closing conditions and in accordance with applicable laws and regulations. Until that time, the two organisations will continue to operate independently.

Continue Reading

Pjazza 1902: New hotspot blends community engagement and B2B offerings

The entertainment hub, which has recently opened in Pembroke after a lengthy period of meticulous restoration, serves up a gamut of dining, fitness, business and leisure opportunities

Gavin Isaacs steps down as Games Global chairman to take on new role as Entain CEO

His appointment comes into effect from September 2024, and will see him remain on the board of Games Global as an independent non-executive director

Third-largest cryptocurrency exchange OKX selects Malta as its MiCA hub

Under the MiCA framework, OKX plans to offer spot trading (including EUR and USDC pairs) in addition to buy, sell, convert and staking services to qualified EU residents through Okcoin Europe Ltd

GO’s Enterprise Solutions geared to deliver end-to-end business technology

The telecoms firm prioritises holistic and scalable solutions for its corporate clients, says Arthur Azzopardi, Chief Officer at GO Business.